owe state taxes california

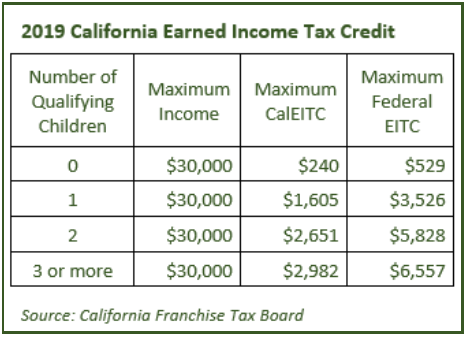

If youre required to make estimated tax payments and your prior year California adjusted gross income is more than. You can get up to 3027.

California Tax Forms H R Block

California state tax rates and tax brackets.

. 1 of taxable income. Use Payment for Automatic Extension. Then you must base.

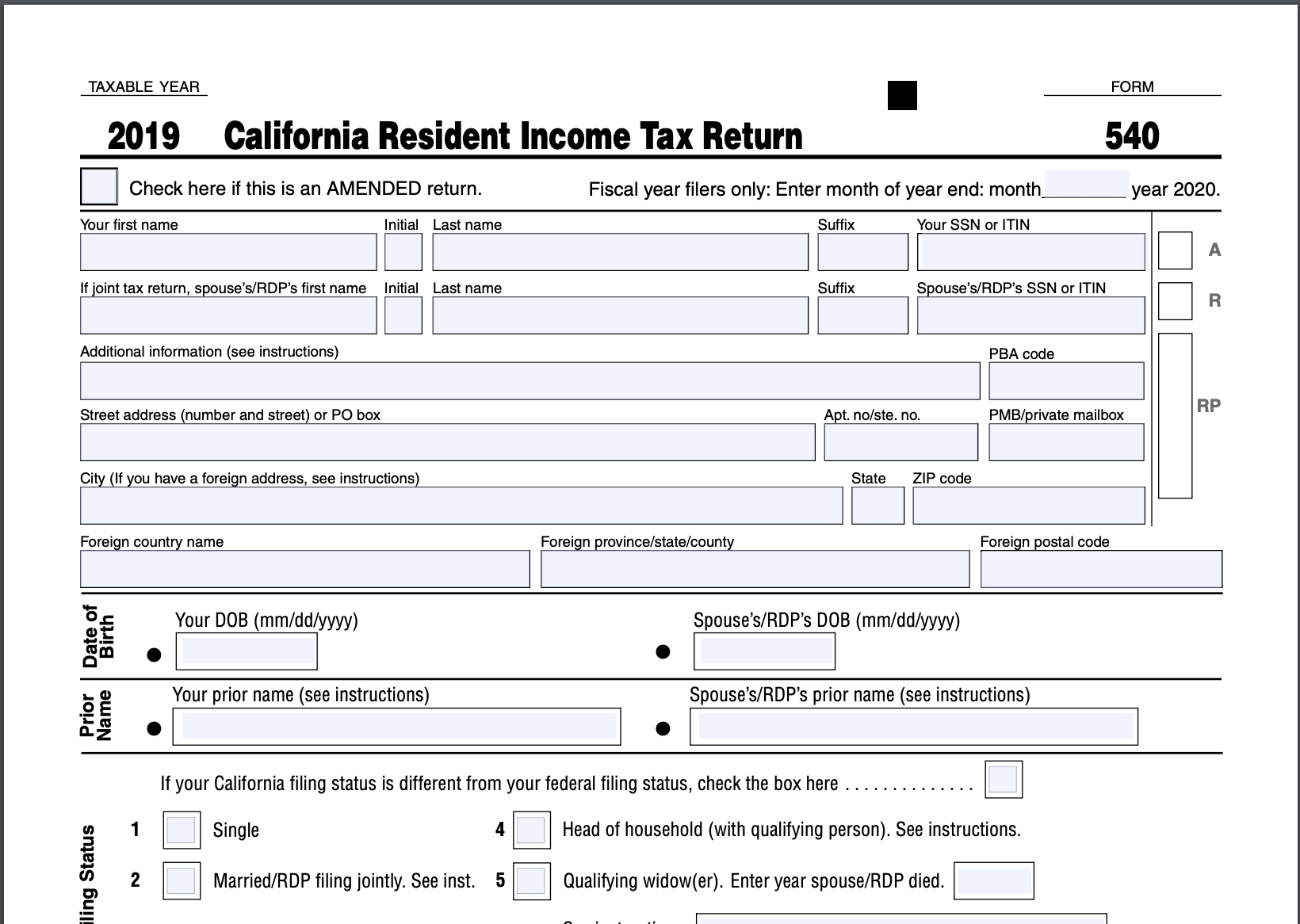

California State Tax Quick Facts. If you filed a Federal tax return and reported income above a certain level you must file a California resident state tax. There are also states that apply no income tax but they still have ways to collect money.

Paying taxes owed to the state of California can be completed either online in person by mail or by telephone. In California the lowest tax bracket is. 073 average effective rate.

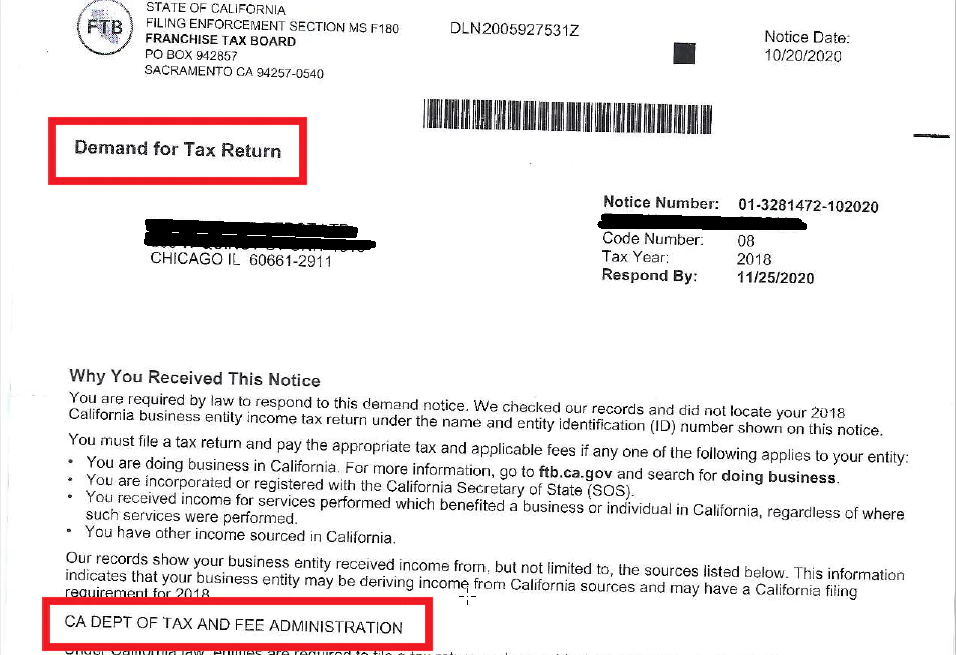

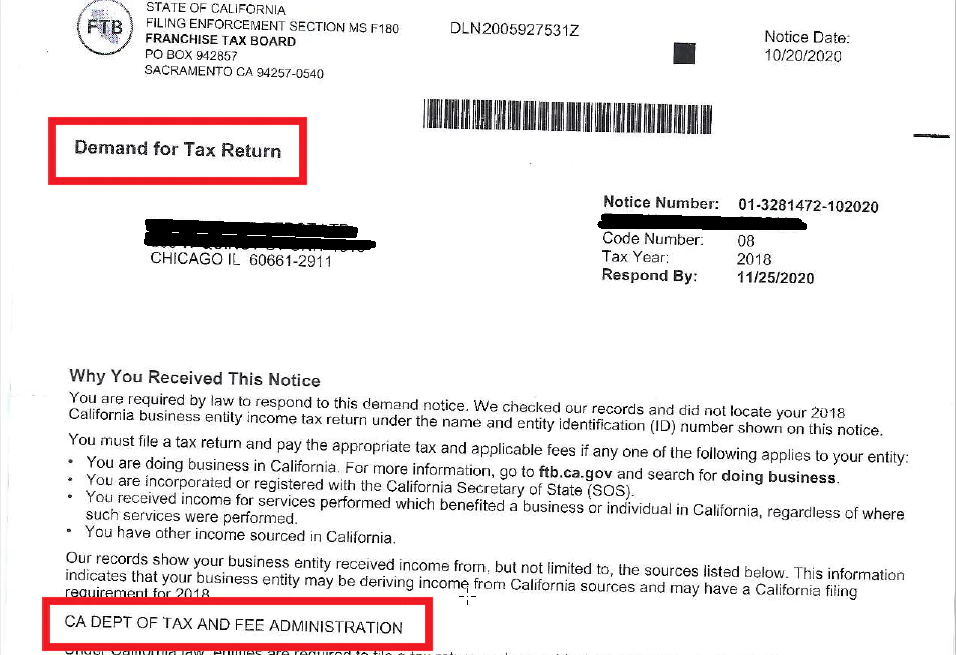

What happens if you owe California state taxes. If you do not owe taxes or have to file you may be able to get a refund. There is a 10 penalty for not filing your return andor paying your full tax or fee payment on time.

75000 if marriedRDP filing separately. For example if a California parent left a child financial assets such as bank accounts and investments within a trust and the child resides out of state there is generally no. California state tax rates are 1 2 4 6 8 93 103 113 and 123.

The sales and use tax rate in a specific California location has three parts. The state tax rate the local tax rate and any district tax rate that may be in effect. If you had money.

An extension to file your tax return is not an extension to pay. Pay the amount you owe by April 18 2022 to avoid penalties and interest. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code.

The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code. Federal tax brackets go from 10 for incomes between 10000 and 19999 to 37 for those earning more than 523600. A 1 mental health services tax applies to income exceeding 1 million.

How much California state tax do I owe. 5110 cents per gallon of regular. Both personal and business taxes are paid to the state.

If you qualify for the California Earned Income Tax Credit EITC 7. Tax rate Taxable income bracket Tax owed. Taxes are not the same in each state they are calculated differently.

Do I need to file a California state tax return if I dont owe.

California Ftb Rjs Law Tax Attorney San Diego

Where S My State Refund Track Your Refund In Every State

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

Understanding California S Sales Tax

California S Tax System A Primer

What Are The State Income Tax Rates For California Quora

Scv News Lookup Table To Help When Filling Out California Income Tax Return Scvnews Com

Which States Pay The Most Federal Taxes Moneyrates

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

I Owe California Ca State Taxes And Can T Pay What Do I Do

California Use Tax Information

Irs Form 540 California Resident Income Tax Return

Handling A Ca Franchise Tax Board Ftb Demand Letter For Out Of State Online Sellers Capforge

Understanding California S Sales Tax

Federal And State Tax Payment Deadlines Extended To July 15 The Santa Barbara Independent

What Are California S Income Tax Brackets Rjs Law Tax Attorney